The Impact of Women on Corporate Boards: A Game Changer for Large Companies

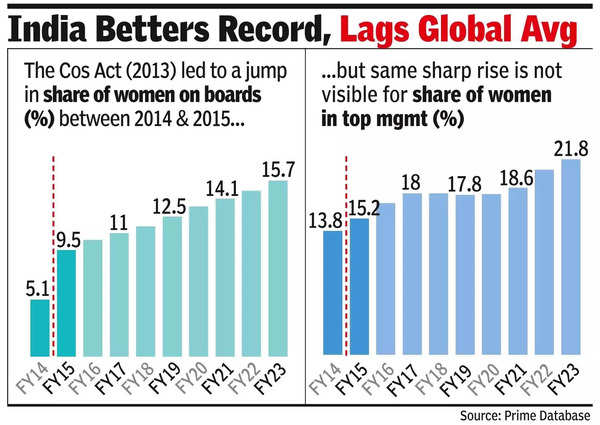

Recent government mandates have significantly increased the presence of women on corporate boards in India, reaching a share of 15.7%. This surge in female representation has not only promoted gender diversity but also positively influenced the financial performance of large companies.

A study conducted by NCAER economists reveals that while the number of women directors has tripled since the mandate took effect in 2015, the proportion of women in senior management roles remains relatively low. The representation of women in top management positions has seen a gradual increase from 13.8% in FY2014 to 21.8% in FY23, indicating progress but also highlighting the need for further growth.

Despite these advancements, India still trails behind the global average of women on boards, with only 20% representation compared to 43% in top-performing countries like France. The study also points out that companies established post-1991 exhibit higher shares of women directors and top management executives.

Interestingly, small-cap firms listed on the NSE have shown greater diversity in board composition, with a 16.5% share of women in 2023 compared to 13.5% for large caps. This disparity can be attributed to smaller boards in small-cap companies, averaging 2.5 women compared to 4.7 in larger firms.

Further analysis of over 2,700 NSE-listed companies reveals that women directors are younger, with an average age of 57 in 2020, compared to 65 for male counterparts. Additionally, women hold more board positions, averaging 1.2 compared to 0.8 for men.

The study concludes that appointing more women to top positions is vital, as companies with at least one woman director demonstrate better economic performance, financial stability, and lower financial risk. Employee ratings and sentiment scores also show improvement with higher shares of women in board positions, especially when women occupy top management roles.