Sebi’s New Regulations Shake Up Stockbroking Firms

MUMBAI: Sebi’s recent move to mandate stockbrokers to charge customers only the actual fees paid to exchanges, clearing houses, and depositories has sent shockwaves through the stockbroking industry. In a circular, Sebi emphasized the need for brokers to be transparent in how they levy charges. This has prompted leading brokers like Zerodha to rethink their pricing strategies, potentially ending the era of zero brokerage.

The impact of these new regulations was clearly felt in the market, with shares of listed stockbroking firms taking a hit. Angel One, the largest listed broker, saw an 8.7% decline, while IIFL Securities fell by 3.5%.

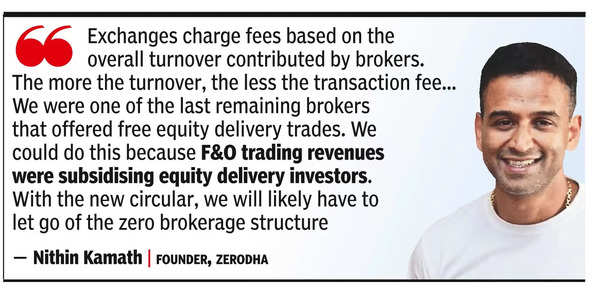

Zerodha’s founder, Nithin Kamath, elaborated on the implications of the new rules in a detailed note. He explained, “Stock exchanges charge transaction fees based on the overall turnover contributed by brokers. The difference between what the brokers charge the customer and what the exchange charges the broker at the end of the month is a rebate, which goes to brokers.” Kamath highlighted that this rebate constitutes a significant portion of brokers’ revenues, and its removal under Sebi’s new circular would have a substantial impact on the industry.

Kamath further noted, “We were one of the last remaining brokers that offered free equity delivery trades. With the new circular, we will likely have to let go of the zero brokerage structure and/or increase brokerage for F&O trades.” This shift in pricing strategy could reshape the competitive landscape of the stockbroking industry.