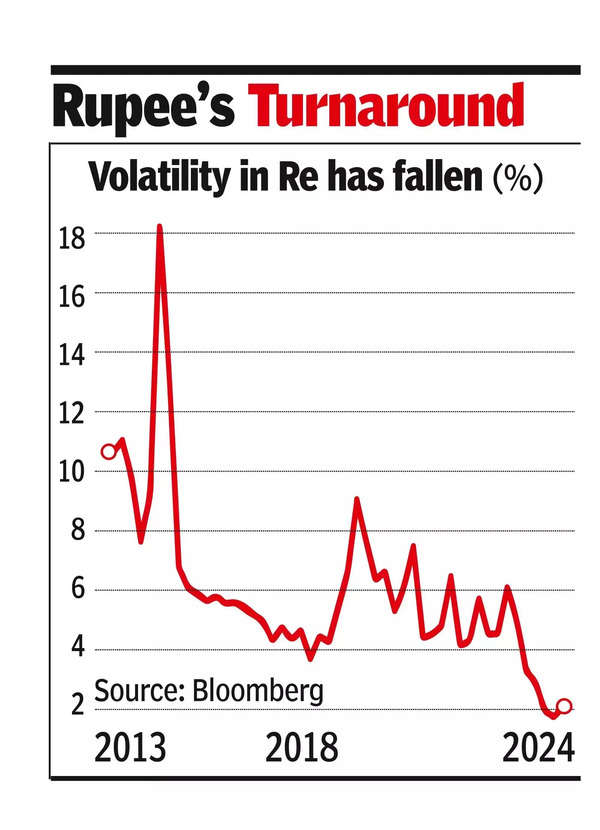

Welcome to our blog post discussing the fascinating transformation of the Indian rupee from one of Asia’s most volatile currencies to one of the most stable in just a decade. This turnaround not only reflects India’s growing economic strength but also the strategic interventions by the Reserve Bank of India (RBI) to manage the currency’s erratic fluctuations. As India’s bonds prepare to enter a crucial global index this week, the newfound stability of the rupee enhances the attractiveness of Indian assets for investors, coming at a perfect time.

The Journey from Volatility to Stability

Around ten years ago, India faced high inflation rates of about 10%, fueled partly by government spending after the global financial crisis. With crude oil prices soaring above $100 per barrel and concerns over political instability and policy paralysis, India’s economic outlook appeared bleak. These factors, along with the Federal Reserve’s tapering of bond purchases in 2013, triggered a wave of capital outflows from emerging markets like India back to the US, causing the rupee to be highly volatile.

Around ten years ago, India faced high inflation rates of about 10%, fueled partly by government spending after the global financial crisis. With crude oil prices soaring above $100 per barrel and concerns over political instability and policy paralysis, India’s economic outlook appeared bleak. These factors, along with the Federal Reserve’s tapering of bond purchases in 2013, triggered a wave of capital outflows from emerging markets like India back to the US, causing the rupee to be highly volatile.

Factors that Curbed Wild Swings

Despite continued depreciation against the dollar during Modi’s tenure, the rupee’s fluctuations gradually subsided. Factors such as robust economic growth, policy stability, and foreign investor confidence led to a positive shift. The government implemented vital reforms, including giving the RBI an inflation-target mandate and reducing budget deficits. Currently, India boasts the world’s fourth-largest foreign reserves, with the RBI actively managing currency movements by buying and selling dollars to mitigate large swings.

Despite continued depreciation against the dollar during Modi’s tenure, the rupee’s fluctuations gradually subsided. Factors such as robust economic growth, policy stability, and foreign investor confidence led to a positive shift. The government implemented vital reforms, including giving the RBI an inflation-target mandate and reducing budget deficits. Currently, India boasts the world’s fourth-largest foreign reserves, with the RBI actively managing currency movements by buying and selling dollars to mitigate large swings.

Implications of Reduced Volatility for Investors

Indian assets now offer higher returns adjusted for volatility compared to other emerging markets, providing investors with more predictable performance. This stability in the local currency contrasts with the unpredictable fluctuations seen in economies across Latin America and Africa. However, the RBI’s tight control over the currency may not always fully reflect changes in economic fundamentals.

Indian assets now offer higher returns adjusted for volatility compared to other emerging markets, providing investors with more predictable performance. This stability in the local currency contrasts with the unpredictable fluctuations seen in economies across Latin America and Africa. However, the RBI’s tight control over the currency may not always fully reflect changes in economic fundamentals.

Significance of Bond Index Inclusion

The recent decision by JP Morgan to include India’s debt in its emerging-market index from June 28 presents new challenges for policymakers. As foreign investors increasingly enter the bond market, there is potential for additional volatility in the rupee. The government must maintain fiscal discipline to prevent adverse reactions from investors.

The recent decision by JP Morgan to include India’s debt in its emerging-market index from June 28 presents new challenges for policymakers. As foreign investors increasingly enter the bond market, there is potential for additional volatility in the rupee. The government must maintain fiscal discipline to prevent adverse reactions from investors.