In the last five years, the sensex has doubled to 80,000, marking a significant milestone for retail investors in India. The dominance of deep-pocketed foreign funds on Dalal Street has been challenged by the emergence of individual investors. This shift has been fueled by a steady increase in investments, particularly through mutual funds, following the bull rally that began after the Covid crash in March 2020.

Unlike foreign fund managers who faced challenges due to global disruptions like the pandemic and spikes in inflation, retail investors remained steadfast in their approach. Investing in stocks and mutual funds using mobile apps and other digital platforms has become increasingly popular among individuals, contributing to the ongoing bull run in the market.

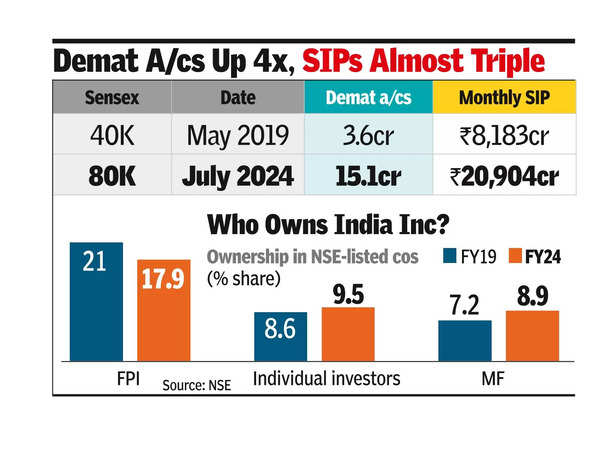

The surge in demat accounts and monthly mutual fund SIP amounts reflects the growing interest of individual investors in the equity market. Since May 2019, the number of demat accounts has quadrupled to 15.1 crore, while MF SIP flows have nearly tripled to Rs 21,000 crore.

Virendra Somwanshi, from Bank of Baroda, acknowledges the significant role retail investors play in driving the market to all-time-high levels. Improved financial literacy and digital infrastructure have made it easier for individuals to invest in stocks and mutual funds, leading to an increase in market participation.

With rising SIP flows and stock prices, the mutual fund industry’s assets under management (AUM) have more than doubled in five years, reaching Rs 59 lakh crore. Swarup Mohanty, CEO of Mirae Asset Investment Managers, emphasizes how this reflects investors’ wealth creation through a long-term investment approach.

Individual investors’ contribution has provided mutual fund companies with the necessary support to counter foreign fund selloffs effectively. Tirthankar Patnaik, NSE chief economist, highlighted the role of domestic investors in sustaining market momentum amid foreign outflows.

According to NSE data, the number of companies with over 50,000 individual shareholders has doubled in the last decade, showcasing the growing retail investor base. While retail investors in India currently represent around 10% of the population, there is room for further expansion compared to the US, where the share is nearly 60%.