Welcome to the exciting world of Indian government bonds! A significant milestone was achieved as Indian government bonds made their way into the JP Morgan emerging market bond index on Friday. This development is poised to have a profound impact on various aspects of the economy, offering a multitude of benefits for businesses, the rupee, and the overall balance of payments.

The inclusion of Indian bonds in the index will not only reduce the cost of long-term borrowings for businesses but also enhance stability for the rupee. With immediate demand expected from index-tracking funds aligning their portfolios, this move will boost visibility and credibility for Indian bonds, making them more attractive to a wider range of foreign investors.

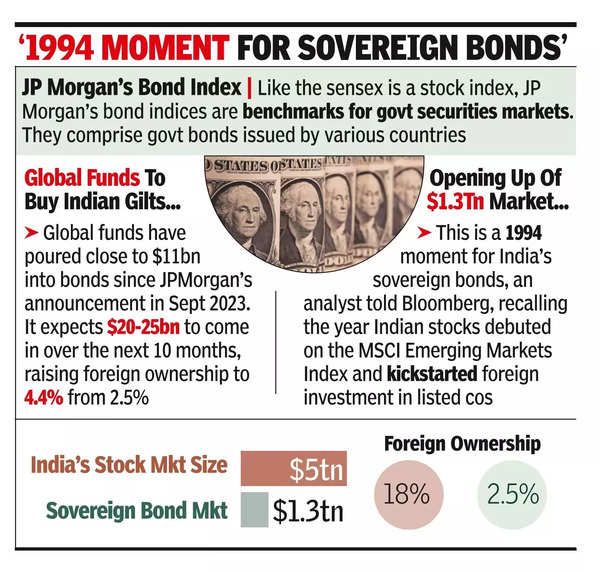

It is estimated that this development could attract $20-25 billion of foreign investment into India by FY25, thanks to the 10% weightage Indian bonds will have in the index. Index-chasing funds wasted no time in the initial phases, injecting up to $500 million into the bond markets on Friday, resulting in a stronger rupee against the dollar.

India’s local debt stock of $1.3 trillion government bonds ranks as the second-largest in emerging markets, with the bonds included in the index exceeding $400 billion, second only to China. The country’s position as having the largest government bond market in the region stems from a historically large fiscal deficit wherein banks were predominant investors. Now, with foreign investors stepping in, banks will have more liquidity to lend, leading to better rates.

What makes Indian government bonds so compelling for investors is their relatively high yields compared to other index constituents. The positive real yields, low volatility in the rupee, supportive macro backdrop, strong reserves, and ongoing fiscal consolidation make Indian government bonds an attractive option for both active managers and passive investors.

In conclusion, this significant move towards inclusion in the JP Morgan index sets the stage for a new era for Indian government bonds. The influx of foreign investment, the strengthening of the rupee, and the overall boost to the economy paint a promising picture for India’s financial landscape. Stay tuned for more updates on this exciting development!