The Sensex Hits a New High: Should You Wait for a Correction?

The Sensex has hit a new high, breaking previous records like 50,000 and 75,000. However, veteran investor Peter Lynch advises against waiting for corrections, stating that more money has been lost preparing for corrections than in the corrections themselves.

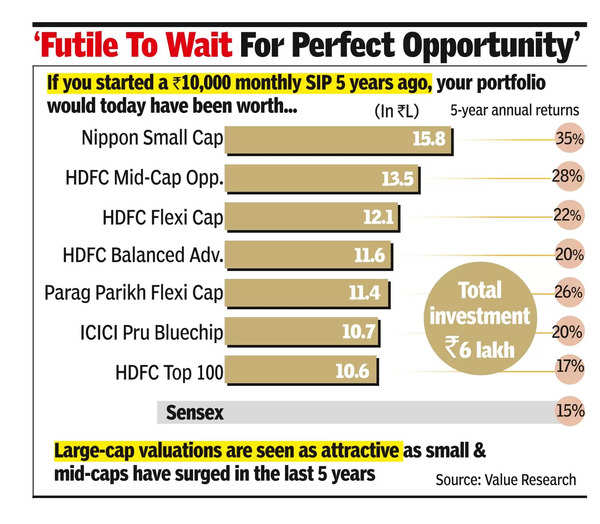

In hindsight, past milestones like 50,000 and 75,000 appear as buying opportunities. Investors who bought at earlier ‘record high’ levels have earned double-digit returns (see top graphic).

“The market has reached at least one new all-time high every calendar year for the last 8 years straight. In 2024 alone, the Sensex closed at new lifetime highs 25 times. It may seem daunting to invest in such high markets, but waiting for the perfect opportunity may cause you to miss out,” said Apurva Sheth, head of market perspectives & research at Samco Securities.

The 10,000-point jump from 70,000 to 80,000 represents a 14.4% growth. The journey from 80,000 to 90,000 will require just a 12.5% gain. Maintaining a consistent investment approach, regardless of new highs, is a prudent strategy.

When deciding what to invest in, Virendra Somwanshi, head of wealth management & capital markets at Bank of Baroda, suggests that large caps offer more favorable valuations compared to mid & small-caps. A flexi-cap strategy with a large-cap bias, while tactically allocating to mid and small-caps, is preferred in the current market scenario.

Considering the future, investing with a horizon of more than 5 years and using a staggered approach is advised. Stock prices should not be viewed in isolation, but rather considering their valuation relative to future earnings. Well-managed companies tend to grow more than the Sensex, especially in a growing economy.

Furthermore, the rally has global support, as the S&P has outperformed the Sensex this year. Fundamental factors such as robust GDP growth and impressive corporate earnings also back the current rally.

Despite the positive outlook, investors should remain cautious of high valuations in the broader market. Another potential risk is a trade war between the US and China if Donald Trump returns as US President.