UltraTech Cement Acquires 23% Stake in India Cements

MUMBAI/CHENNAI: UltraTech Cement, controlled by Kumar Mangalam Birla, has taken a significant step in the cement industry by acquiring a 23% stake in India Cements from veteran investor Radhakishan Damani for Rs 1,885 crore. This move elevates the rivalry between UltraTech and competitors like Ambuja Cements and ACC as they aim to challenge UltraTech’s position as India’s largest building materials maker.

The transaction positions Birla as the second-largest shareholder of India Cements, behind the founders, N Srinivasan and family. UltraTech sees this acquisition as a non-controlling financial investment, acquiring shares at a 9% discount to the stock’s closing price on BSE.

This strategic investment by UltraTech is seen as a preventive and proactive strategy according to former Ambuja Cements CEO and founder of advisory firm I can Investment, Anil Singhvi. He believes that this move is a good deal for the sellers and provides them with a reasonable value and a complete exit.

The transaction values India Cements, with a capacity of 14.5 million tonnes, at Rs 10,800 crore. Industry analysts speculate that UltraTech might increase its stake in the future, potentially converting India Cements into a strategic asset.

This investment comes at a crucial time for India Cements, which has been facing challenges meeting its working capital needs. UltraTech’s acquisition, along with the recent Kesoram acquisition, will help the company maintain its stronghold in the southern region of India where competitors like Ambuja-ACC are also expanding.

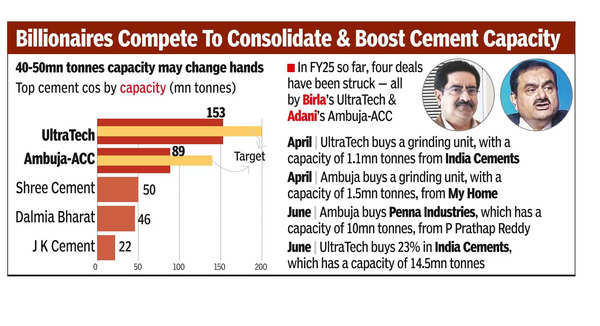

Under Birla’s leadership, UltraTech has scaled up to become India’s largest cement player with a capacity of 153 million tonnes. The cement sector, expected to double by 2029, has seen increased competition with the entry of Adani through the acquisition of Ambuja-ACC.

With mergers and acquisitions expected to continue in the cement sector, analysts predict a significant shift in capacities among major players in the coming years.